By Les Leopold, AlterNet

Posted on October 23, 2011, Printed on October 24, 2011

http://www.alternet.org/story/152811/the_shocking%2C_graphic_data_that_shows_exactly_what_motivates_the_occupy_movement

What are the Occupy Wall Street protesters angry about? The same things we’re all angry about. The only difference is the protestors turned their anger into public action. Occupy Wall Street lit the embers and the sparks are flying. Whether it turns into a genuine populist prairie fire depends on all of us.

Now is not the time for wonky policy solutions, as the media meatheads are calling for. Rather, it’s time to air our grievances as loudly as possible, which is precisely what Wall Street and its minions fear the most. Here’s a brief list of why we should be angry and the charts to back it up.

1. The American Dream is imploding...

The productivity/wage chart says it all. From 1947 until the mid-1970s real wages and productivity (economic output per worker hour) danced together. Both climbed year after year as did our real standard of living. If you’re old enough, you will remember seeing your parents doing just a bit better each year, year after year. Then, our nation embarked on a grand economic experiment. Taxes were cut especially on the super-rich. Finance was deregulated and unions were crushed. Lo and behold, the two lines broke apart. Productivity continued to climb, but wages stalled and declined. So where did all that productivity money go? To the rich and to the super-rich, especially to those in finance.

2. Our wealth is gushing to the top 1 percent...

Actually the top tenth of one percent. Because of financial deregulation and tax cuts for the rich, the income gap is soaring. Here’s one of my favorite indicators that we compiled for The Looting of America. In 1970 the top 100 CEOs earned $45 for every $1 earned by the average worker. By 2006, the ratio climbed to an obscene 1,723 to one. (Not a misprint!)

3. Family income is declining while the top earners flourish...

As women entered the workforce, family income made up for some of the wage stagnation. But now even family incomes are in trouble. Meanwhile, the incomes of the richest families continue to rise.

4. The super-rich are paying lower and lower tax rates...

To add financial insult to injury, the richest of the rich pay less and less each year as a percentage of their monstrous incomes. The top 400 taxpayers during the 1950s faced a 90 percent federal tax rate. By 1995 their effective tax rate – what they really paid after all deductions as a percent of all their income – fell to 30 percent. Now it’s barely 16 percent.

5. Too much money in the hands of the few combined with financial deregulation crashed our economy...

2. Our wealth is gushing to the top 1 percent...

Actually the top tenth of one percent. Because of financial deregulation and tax cuts for the rich, the income gap is soaring. Here’s one of my favorite indicators that we compiled for The Looting of America. In 1970 the top 100 CEOs earned $45 for every $1 earned by the average worker. By 2006, the ratio climbed to an obscene 1,723 to one. (Not a misprint!)

3. Family income is declining while the top earners flourish...

As women entered the workforce, family income made up for some of the wage stagnation. But now even family incomes are in trouble. Meanwhile, the incomes of the richest families continue to rise.

4. The super-rich are paying lower and lower tax rates...

To add financial insult to injury, the richest of the rich pay less and less each year as a percentage of their monstrous incomes. The top 400 taxpayers during the 1950s faced a 90 percent federal tax rate. By 1995 their effective tax rate – what they really paid after all deductions as a percent of all their income – fell to 30 percent. Now it’s barely 16 percent.

5. Too much money in the hands of the few combined with financial deregulation crashed our economy...

When the rich become astronomically rich, they gamble with their excess money. And when Wall Street is deregulated, it creates financial casinos for the wealthy. When those casinos inevitably crash, we pay to cover the losses. The 2008 financial crash caused eight million American workers to lose their jobs in a matter of mont

6. We’re turning into a billionaire bailout society...

We bailed out the big Wall Street banks and protected the billionaires from ruin. Now we are being asked to make good on the debts they caused, while the super-rich get even richer, some making more than $2 million an HOUR! It would take over 47 years for the average family to make as much as the top 10 hedge fund managers make in one hour.

7. The super-rich still control politics...

Both political parties are occupied by Wall Street. For nearly an entire generation they have competed with each other to gain campaign contributions in exchange for tax breaks and regulatory loopholes for the richest of the rich. Today’s so-called financial reforms are porous, while the money continues to flow to both parties.

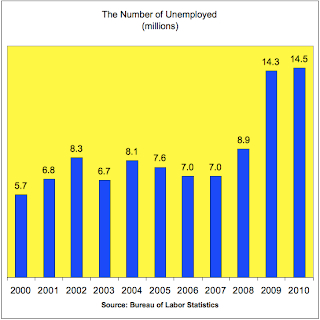

8. Unemployment is a catastrophe...

The reckless gambling on Wall Street tore a hole in the economy sending millions to the unemployment lines. Wall Street caused the enormous spike in unemployment and no one else – not the government, not home buyers, not China.

9. Our prospects for the future are growing dim...

hs due to no fault of their own. The last time we had so much money in the hands of so few was 1929!

6. We’re turning into a billionaire bailout society...

We bailed out the big Wall Street banks and protected the billionaires from ruin. Now we are being asked to make good on the debts they caused, while the super-rich get even richer, some making more than $2 million an HOUR! It would take over 47 years for the average family to make as much as the top 10 hedge fund managers make in one hour.

7. The super-rich still control politics...

Both political parties are occupied by Wall Street. For nearly an entire generation they have competed with each other to gain campaign contributions in exchange for tax breaks and regulatory loopholes for the richest of the rich. Today’s so-called financial reforms are porous, while the money continues to flow to both parties.

8. Unemployment is a catastrophe...

The reckless gambling on Wall Street tore a hole in the economy sending millions to the unemployment lines. Wall Street caused the enormous spike in unemployment and no one else – not the government, not home buyers, not China.

9. Our prospects for the future are growing dim...

It’s bad enough that unemployment is sky-high. But it’s even worse when you can’t find a job for months, even years. Right now the number of unemployed for 26 weeks or more is at record levels. Many of the long-term unemployed will never work again.

10. The big banks are getting even bigger...

Too big to fail is alive and well. Our nation’s biggest banks are growing larger and larger with no end in sight. Despite what politicians say, the taxpayer will bail out the big banks again. And the big banks know it.

Stand up and be counted!

Americans are a patient people. Mass movements do not form very often. Most of us hoped that after the crash, the big banks would be broken up, the casinos would be shut down and the gamblers would be punished. At the very least, we expected that the elite financiers would pay for the damage they created – the jobs destroyed, the neighborhoods wrecked, the services cut. It didn’t happen. Finally something clicked. A small number of kids stood up and got noticed. And now it’s growing. We see an outlet for our frustration, our justifiable anger, our disappointment in leaders who sold out.

We don’t know where it’s all going. But this is the time to stand up and be counted – literally. The currency of a populist revolt is numbers in the street. Let’s show our anger where it will be seen. And let us take heart from the words of Franklin Roosevelt who during his first inaugural address in 1933, led the first occupation of Wall Street:

Les Leopold is the executive director of the Labor Institute and Public Health Institute in New York, and author of The Looting of America: How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity—and What We Can Do About It (Chelsea Green, 2009).

© 2011 Independent Media Institute. All rights reserved.

10. The big banks are getting even bigger...

Too big to fail is alive and well. Our nation’s biggest banks are growing larger and larger with no end in sight. Despite what politicians say, the taxpayer will bail out the big banks again. And the big banks know it.

Stand up and be counted!

Americans are a patient people. Mass movements do not form very often. Most of us hoped that after the crash, the big banks would be broken up, the casinos would be shut down and the gamblers would be punished. At the very least, we expected that the elite financiers would pay for the damage they created – the jobs destroyed, the neighborhoods wrecked, the services cut. It didn’t happen. Finally something clicked. A small number of kids stood up and got noticed. And now it’s growing. We see an outlet for our frustration, our justifiable anger, our disappointment in leaders who sold out.

We don’t know where it’s all going. But this is the time to stand up and be counted – literally. The currency of a populist revolt is numbers in the street. Let’s show our anger where it will be seen. And let us take heart from the words of Franklin Roosevelt who during his first inaugural address in 1933, led the first occupation of Wall Street:

Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True, they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit, they have proposed only the lending of more money.

Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored conditions. They know only the rules of a generation of self-seekers.

They have no vision, and when there is no vision the people perish.

The money changers have fled their high seats in the temple of our civilization. We may now restore that temple to the ancient truths.

The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

Happiness lies not in the mere possession of money, it lies in the joy of achievement, in the thrill of creative effort.

The joy and moral stimulation of work no longer must be forgotten in the mad chase of evanescent profits. These dark days will be worth all they cost us if they teach us that our true destiny is not to be ministered unto but to minister to ourselves and to our fellow-men.

Recognition of the falsity of material wealth as the standard of success goes hand in hand with the abandonment of the false belief that public office and high political position are to be values only by the standards of pride of place and personal profit, and there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing.

Les Leopold is the executive director of the Labor Institute and Public Health Institute in New York, and author of The Looting of America: How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity—and What We Can Do About It (Chelsea Green, 2009).

No comments:

Post a Comment